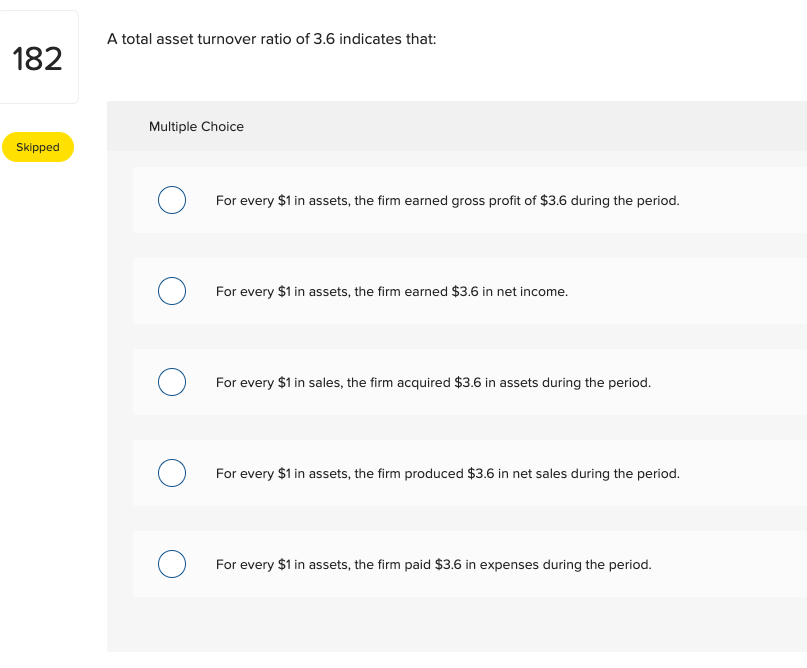

What is the total asset turnover ratio?

• Accounts receivable are accounts that hold expected revenues that come from when customers use credit to buy goods and services.

What are the implications of a total asset turnover ratio below 1?

- It may indicate management is unable to invest enough to boost the business to its full potential.

- Irrespective of whether the total or fixed variation is used, the asset turnover ratio is not practical as a standalone metric without a point of reference.

- Sometimes investors also want to see how companies use more specific assets like fixed assets and current assets.

- The Asset Turnover Ratio is a performance measure used to understand the efficiency of a company in using its assets to generate revenue.

- On the other hand, Telecommunications, Media & Technology (TMT) may have a low total asset turnover due to their high asset base.

To calculate average total assets, add up the beginning and ending balances of all assets on your balance sheet. Be sure not to count anything twice in this calculation, like cash in the bank accounts, which would be included in both beginning and ending balances. A high total asset turnover means that the company is able to generate more revenue per unit asset. On the other hand, a low total asset turnover suggests that the company is unable to generate satisfactory results with the asset it has in hand. Being able to assess a company’s efficiency is one of the main steps when analyzing investment opportunities.

Why You Can Trust Finance Strategists

On the other hand, company XYZ, a competitor of ABC in the same sector, had a total revenue of $8 billion at the end of the same fiscal year. Its total assets were $1 billion at the beginning of the year and $2 billion at the end. Just-in-time (JIT) inventory management, for instance, is a system whereby a firm receives inputs as close as possible to when they are needed. So, if a car assembly plant needs to install airbags, it does not keep a stock of airbags on its shelves but receives them as those cars come onto the assembly line. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

Applying Total Asset Turnover in Business Analysis

Total asset turnover is a financial metric used to assess a company’s efficiency in using its assets to generate sales. The fixed asset turnover ratio is intended to isolate the efficiency at which a company uses its fixed asset base to generate sales (i.e. capital expenditure). It is the gross sales from a specific period less returns, allowances, or discounts taken by customers. When comparing the asset turnover ratio between companies, ensure the net sales calculations are being pulled from the same period. The asset turnover ratio can vary widely from one industry to the next, so comparing the ratios of different sectors like a retail company with a telecommunications company would not be productive. Comparisons are only meaningful when they are made for different companies within the same sector.

However, Target isn’t too far behind, especially when it comes to shipping packages to customers from its stores. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The ratio can also change significantly from year to year, so just because it’s low one year doesn’t mean it will remain low over time. Thus, a sustainable balance must be struck between being efficient while also spending enough to be at the forefront of any new industry shifts.

Total Asset Turnover Ratio: A Practical Guide

It is useful for comparing similar companies, but isn’t a sufficient tool for doing a complete stock analysis of any particular company. Companies can work on improving their asset turnover ratio by increasing sales, decreasing manufacturing costs, and improving their inventory management. Other ways they can improve include adding new products and services that don’t require the use of assets, and selling any unsold inventory still on hand. The best approach for a company to improve its total asset turnover is to improve its efficiency in generating revenue.

Conversely, a high asset turnover ratio may be less significant for businesses with high-profit margins, as they make substantial profits on each sale. Knowing how to calculate asset turnover and how to use it to identify companies with competitive advantages can help uncover good investment opportunities. At its core, asset turnover is a measure of how well management does at efficiently using its capital. One interprets a company’s total asset turnover figure by assessing how well it utilizes its assets.

Since company assets require a great deal of investment, management spends much of its time deciding what assets to purchase and when assets should be purchased or leased. For instance, a manufacturing plant wouldn’t be able to manufacture products without proper machinery and manufacturing equipment. Unlike other turnover ratios, like the inventory turnover ratio, the asset turnover ratio does not calculate how many times assets are sold. Also, keep in mind that a high ratio is beneficial for a business with a low-profit margin as it means the company is generating sufficient sales volume.

XYZ has generated almost the same amount of income with over half the resources as ABC. A high asset turnover ratio indicates a company that is exceptionally effective at extracting a high level of revenue from a relatively low number of assets. As with other business metrics, the asset turnover ratio is most effective when used to compare different companies in the same industry. To accomplish this, the ratio directly measures a firm’s net sales against its average assets, to determine exactly what percentage of those sales is being produced from each dollar of a company’s resources.

It’s used to evaluate how well a company is doing at using its assets to generate revenue. One common variation—termed the “fixed asset turnover ratio”—includes only long-term fixed assets (PP&E) in the calculation, as opposed to all assets. The asset turnover ratio is used to evaluate how efficiently a company is using 5 ways to improve the seo of your small business internet website its assets to drive sales. It can be used to compare how a company is performing compared to its competitors, the rest of the industry, or its past performance. Though ABC has generated more revenue for the year, XYZ is more efficient in using its assets to generate income as its asset turnover ratio is higher.