How Types of Credit Affect Your Credit Scores

With each new form of credit, your history will reflect a more diverse credit mix. By maintaining different types of credit over longer periods, both revolving credit and installment debt, you can demonstrate more financial responsibility. The downsides to trying to improve your credit mix opening new accounts include the fact that opening new accounts has a negative impact on your credit score.

What’s the Best Way to Use Credit Cards to Boost Your Score?

This can be a quick way to increase your score by “inheriting” the account’s positive attributes, like on-time payments and low balances. This means on-time payments are the most crucial factor in maintaining a high score. Late payments, especially those 30 days or more overdue, can hurt your score for up to seven years. To know your credit mix, you can obtain a copy of your credit report from one or all of the three major credit bureaus, Equifax, Experian, and TransUnion. Having a mix of credit accounts can also indicate stability and financial responsibility. For example, if a borrower has a mix of credit accounts that they have managed well over time, this can signal to lenders that they are less risky to lend to.

How much does credit mix impact your overall credit score?

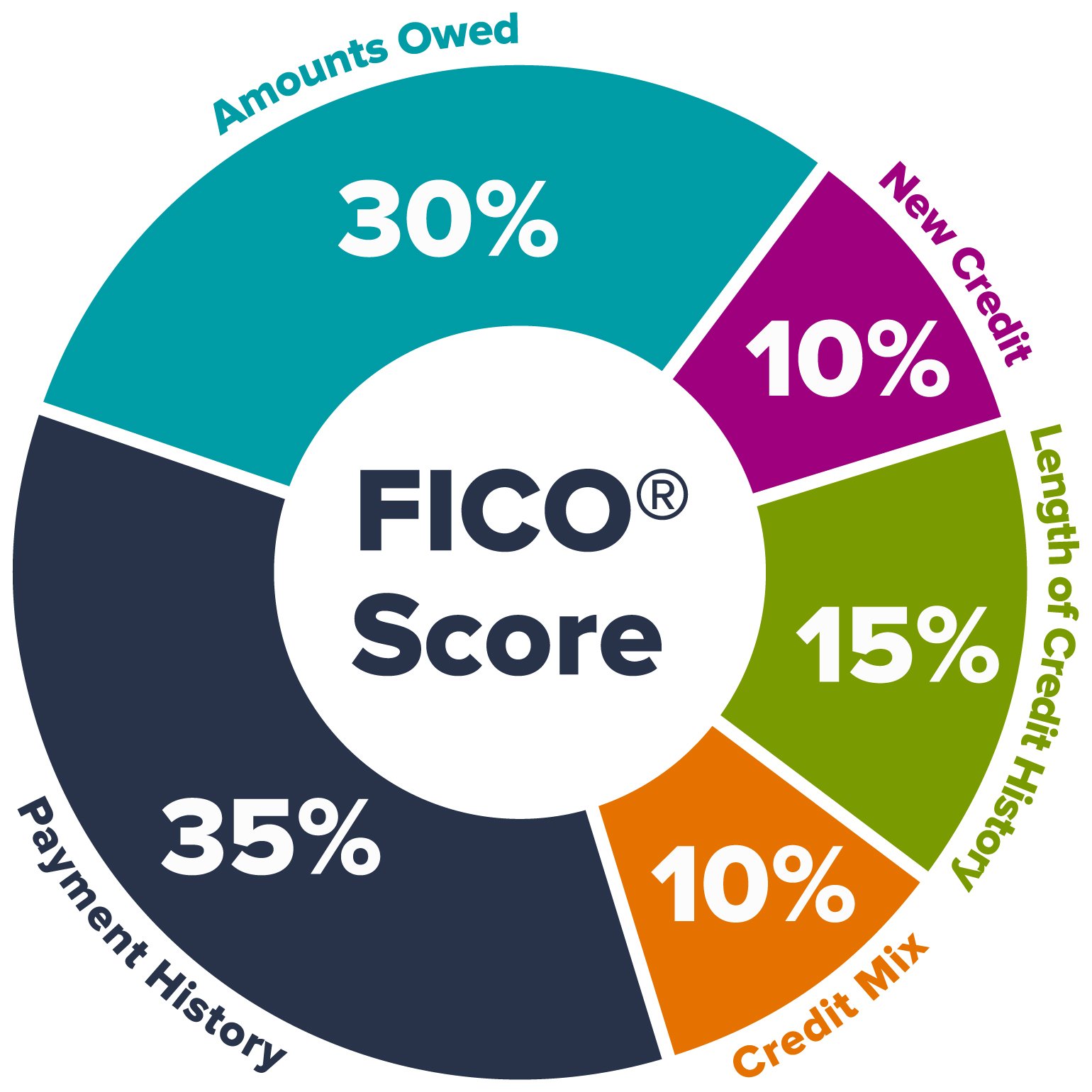

Credit utilization represents the credit you are currently using relative to your available credit. So if you have a $1,000 credit limit on a credit card and spend $300 on the card, your credit utilization is 30%. Credit utilization reflects the amount you owe, which has a more substantial impact on your credit score than your credit mix. Credit mix is a lesser-known aspect of credit, but understanding it can help you interpret and improve your credit score. It contributes to your FICO score, the credit score used in 90% of lending decisions in the U.S., and can communicate to potential lenders how you manage different kinds of credit accounts.

How Does Closing a Credit Card Affect Your Credit Score?

- Our investment professionals are committed to providing you unsurpassed service and financial advice.

- Except for mortgage loan offers, this compensation is one of several factors that may impact how and where offers appear on Credit Karma (including, for example, the order in which they appear).

- When you or a prospective lender pulls your credit report, there’s a list of all the credit accounts that exist (or have existed) in your name.

- You only have a monthly minimum payment which usually covers interest rates or APR.

- In general, lenders and creditors like to see that you have a diverse credit mix – that is, you’ve been able to manage different types of credit accounts responsibly over time.

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. View your car’s estimated value, history, recalls and more—all free.

Avoid opening too many new credit accounts at once

If you only have credit card accounts, how do lenders know you can manage greater responsibility like a mortgage, for instance? Lenders assume if you can manage a mix of credit types consistently, you’re less likely to default. Having only revolving accounts or only installment accounts open will have a negative impact on the Credit Mix portion of your score. You could have 5 accounts reporting to the credit bureaus, but if all of them are revolving accounts, this will be bad for your credit mix.

It’s generally not worth it if you don’t intend to use the account or it means you’ll end up paying extra interest or fees. The long-term rewards of building a good credit mix could outweigh the disappointment that comes from a temporary dip. Lenders will know you’re a pro at managing various credit types and your chances of getting approved for future credit should go up. Keep in mind that lenders could still approve credit applications without a robust credit mix.

In the short term, having several hard inquiries on your credit caused by applying for new products will harm your score and it may cancel out the positive effects of diversifying your credit types. Your credit card account, which you charge and make varying payments on each month, counts as revolving credit. Your balance is forever changing and there is no particular end date to having this type of credit (unless, of course, you close your credit card account). Reviewing your credit report can give you a good sense of your credit mix and whether you have a diverse range of credit accounts. Make sure to check for any errors or inaccuracies in your report that could affect your credit score.

Staying on top of your payments regardless of credit type can help show lenders that you can responsibly handle various types of credit. You generally make the same payment once a month, every month, until the loan is paid off. But revolving credit is a different beast how does credit mix affect credit score — to a certain extent, you get to determine how much you want to borrow and pay off each month as long as you make the minimum payment. And though you have the option to pay only the minimum, it typically means you’ll end up paying interest on the unpaid amount.

Having a mix of different types of loans on your credit report can have a positive impact on your credit score It accounts for 10% of your FICO credit score. You can monitor your credit health and credit mix using CreditWise from Capital One. It’s free for everyone—even if you’re not a Capital One cardholder—and using it won’t hurt your credit scores.